How to Calculate the Accounts Payable Balance

How to Calculate the Balances. 365 TAPT Average Accounts Payable Days.

Accounts Payable Unpaid Expenses Account On The Balance Sheet

Is going to be calculated as follows.

. Payments made to suppliers for the year. Given these issues it may may sense to aggregate the payables balance for every business day of the month and then divide by the total number of business days. To calculate accounts payable on your balance sheet add up the totals of all the invoices you have approved but not yet paid.

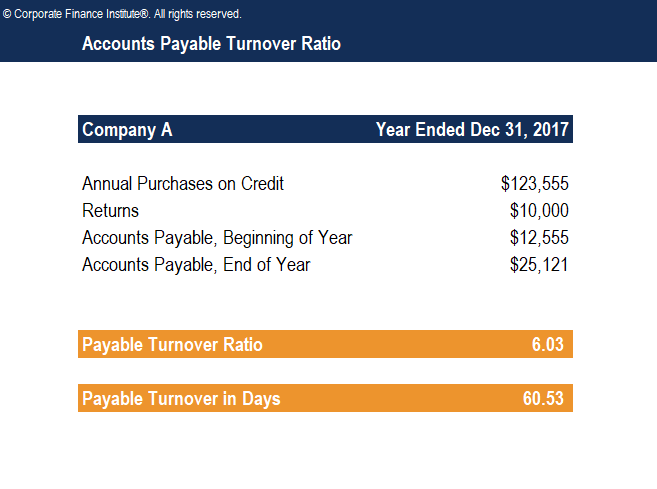

The above examples are based on a full year 365-day period. AP Days Accounts Payable Value Cost of Goods Sold x 365. How to Calculate Average Accounts Payable.

The payment period offered to its customers can be measured using the accounts payable days formula as illustrated below. The formula is. There are a number of issues due to which most of the businesses prefer to aggregate the payable balance at the end of each day of the entire month and then divide this aggregate to the total number of business days.

Once you have your annual TAPT divide it by 365 to find the average accounts payable daysDPO. The formula for calculating AP value is. The figure to use for the accounts payable opening balance is the accounts payable value shown under the heading opening balance sheet in the calculator.

When the amount is settles by the creditor it can be recorded as below. Credit Purchases for the year. In the cash conversion cycle companies match the payment dates with accounts receivables ensuring that receipts are made before making the payments to the suppliers.

To calculate accounts payable on your balance sheet add up the totals of all the invoices you have approved but not yet paid. Accounts Payables Turnover Credit Purchases Average accounts payables365 days. AP Value Accounts Payable Days x Cost of Good Sold 365.

Accounts Payable Opening Balance. This is effectively the amount of accounts payable the business has when it starts trading and forms part of the startup funding together with the opening debt and equity injections. Then divide the resulting turnover figure into 365 days to arrive at the number of accounts payable days.

The formula for calculating AP days is. Average Accounts Payable Cost of Goods Sold or Purchases x 365 Accounts Payable Days DPO Note. For example we divide 110 by 365 and then multiply by 110mm in revenue to get 33mm for the AP balance in 2021.

The second formula shows how we can use forecast sales and receivable days to forecast receivables. The first formula defines the account receivable days ratio. Average accounts receivable 30 800 200 400 500 2000 700 4630 7 661.

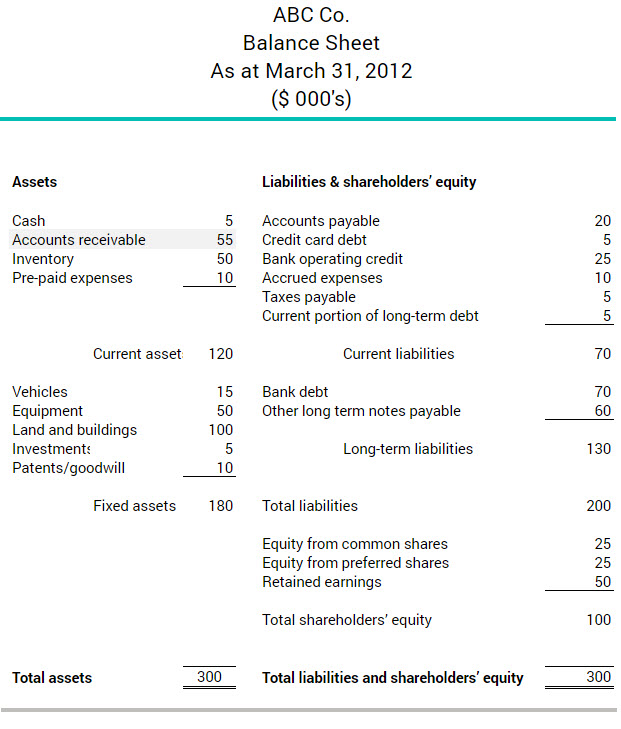

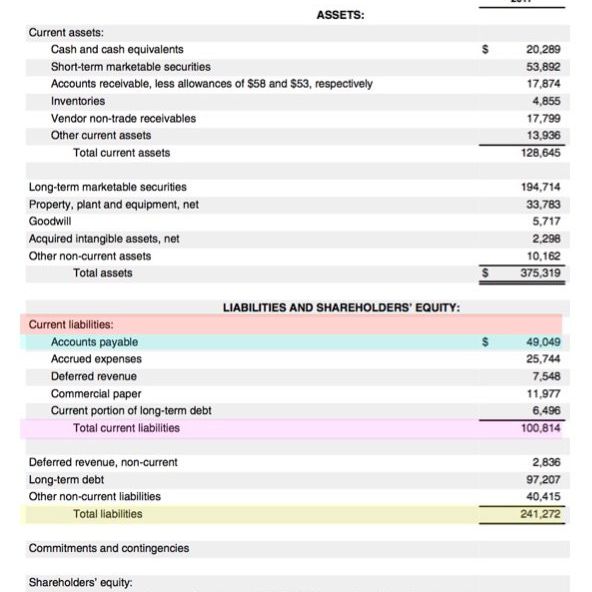

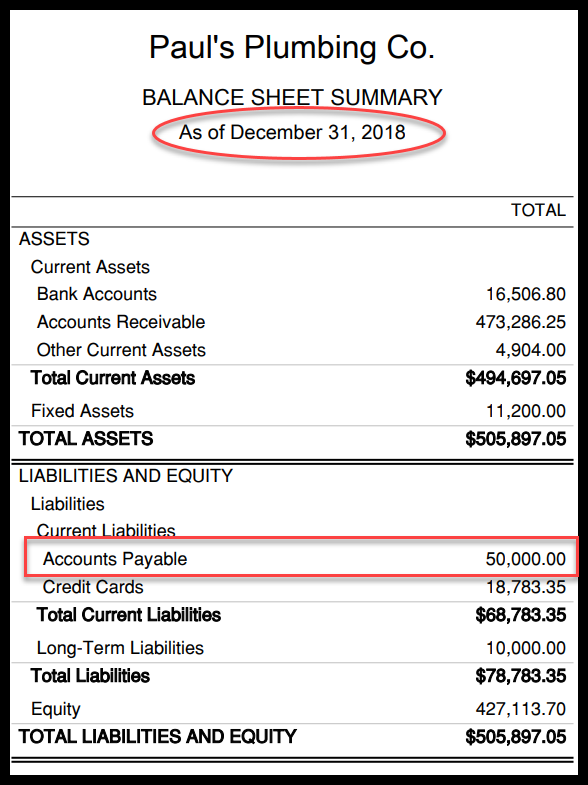

They appear as current liabilities on the balance sheet. How to find the accounts payable balance in QuickBooks Online Select Reports on the left side navigation Click on Balance Sheet Look for the Accounts Payable balance just under the Liability section. To calculate days payable outstanding or DPO the companys total amount of accounts payable are divided by the cost of sales during the same specified given time period.

The opening balance on Accounts Payable Accounts was 100000. This means that on average customers get 661 worth of credit from Richeys Sports Center that they must pay back. Accounts payable include short-term debt owed to suppliers.

Also include any other sums youve accrued that wont be included in your digital or paper bills. When recording an account payable debit the asset or expense account to which a purchase relates and credit the accounts payable account. The accounts receivable ledger total and the balance sheet total must match.

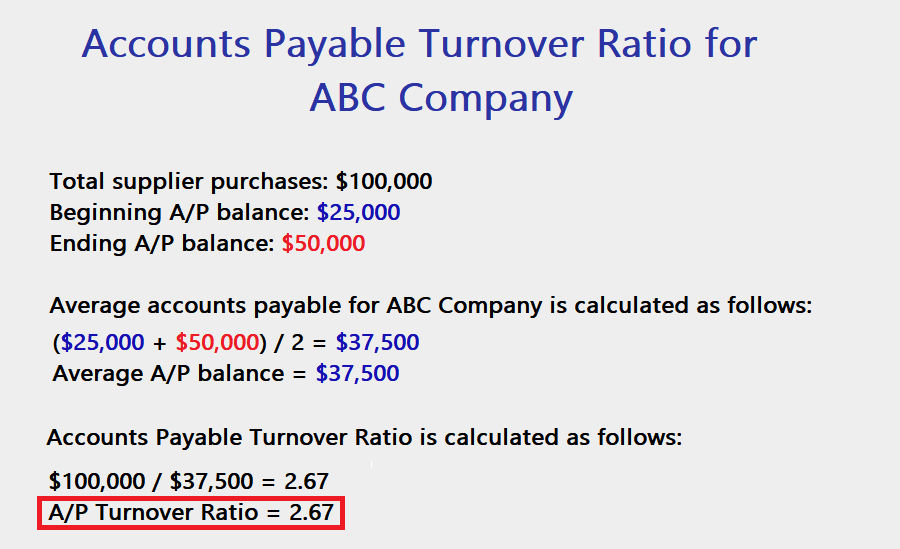

Of course the increased accuracy level comes at the cost of the additional labor required to track the daily payables balance. The completed projections for AP under the DPO approach are shown below. Total supplier purchases Beginning accounts payable Ending accounts payable 2 This formula reveals the total accounts payable turnover.

Accounts payable are liabilities to your business and are recorded as current or short-term liabilities on the balance sheet. To calculate accounts payable on your balance sheet add up the totals of all the invoices you have approved but not yet paid. It represents the purchases that are unpaid by the enterprise.

The 365 in this formula assumes an accounting period of one year but if youre calculating for a different accounting period you can replace it with the number of days in that period eg. Using the 110 DPO assumption the formula for projecting accounts payable is DPO divided by 365 days and then multiplied by COGS. How do you record accounts payable.

Keep your bills together whether you receive them as emails or snail mail. Include the balance for each. When an account payable is paid debit.

Total purchases Beginning accounts payable ending accounts payable 2 Accounts payable turnover ratio Total purchases are all the purchases on credit for. Accounts payable form the largest portion of the current liability section on the companys financial statements. To begin enter all debit accounts on the left side of the balance sheet and all credit accounts on the right.

In a similar manner the accounts payable days ratio can be used to link forecast payables to the cost of sales. Most of the businesses acquire special staff to calculate accounts payable for each day. How do you calculate Days payable.

But you dont need an accounting program to calculate accounts payable. Accounts payable must be settled relatively quickly to avoid default. Any payments received against an invoice will be deducted from the invoice amount to arrive at the net amount due.

By adding up the net amount due for all invoices determines the accounts receivable balance on the balance sheet. In the example above it can be seen that the closing Accounts Payable Balance for Henry Inc. Accounts payable are the opposite of accounts receivable which are current assets that include money owed to the company.

For example lets say your company had a beginning accounts payable balance of 700000 at the start of the year. 30 60 90 etc. After forecasting receivables we can then forecast accounts payable.

Download the Free Template. Total Purchases Beginning AP Ending AP 2 Total Accounts Payable Turnover. Add the amounts of all of the bills in your inbox or physical file to find your accounts payable balance.

Accounts Payable Turnover Ratio Definition Formula Free Template

How To Calculate Ending Balance Of T Account Youtube

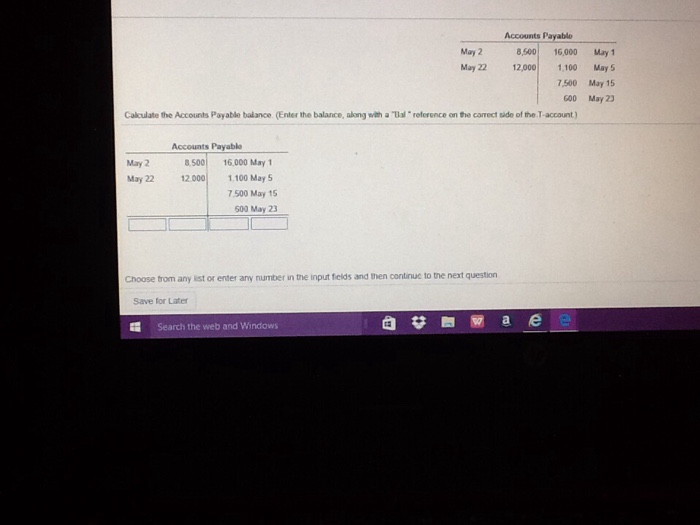

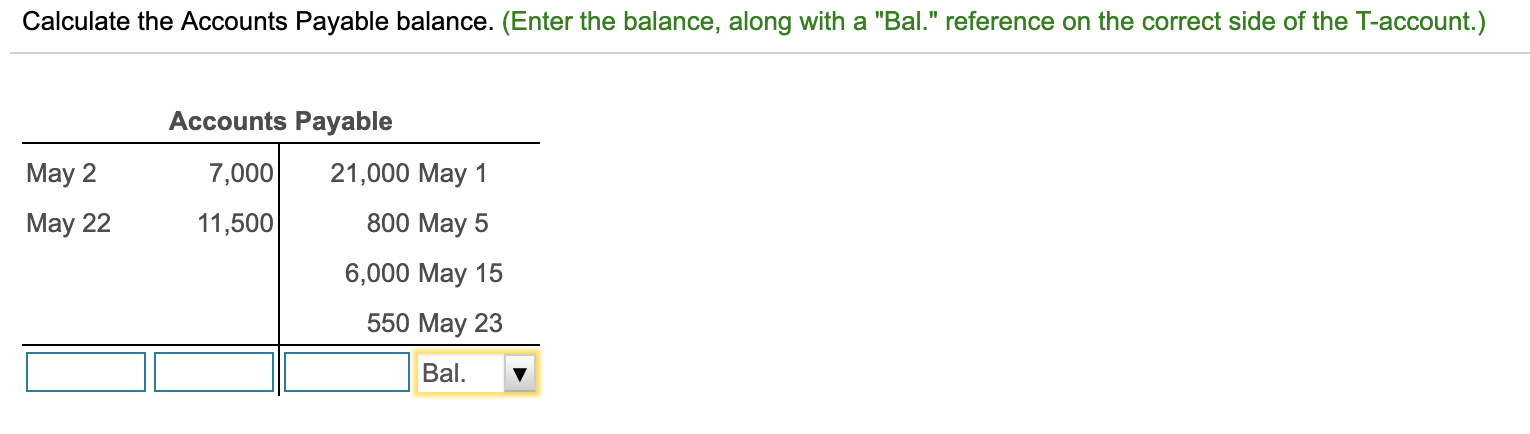

Solved Calculate The Accounts Payable Balance Enter The Balance Along With Solutioninn

Accounts Payable A P U S Gaap Liability Definition

Accounts Payable Turnover Ratio Definition Formula Free Template

Solved 3 Accounts Payable May 2 6 000 21 000 May 22 1 Chegg Com

What Are Accounts Receivable Bdc Ca

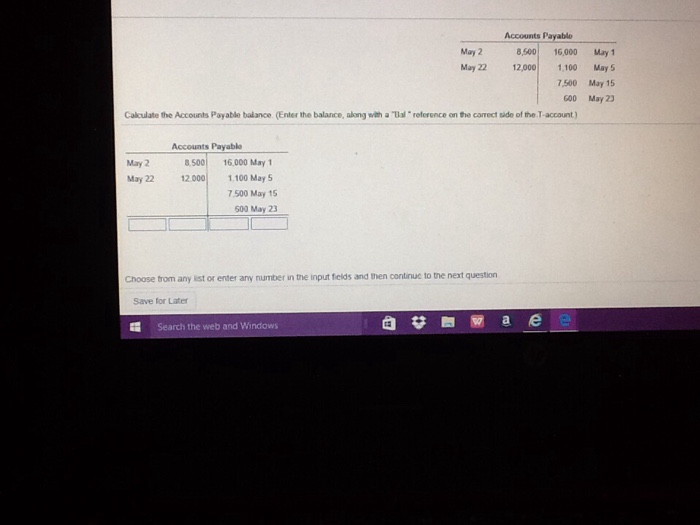

Solved Score 0 Of 1 Pt 13 Of 28 12 Complete Hw Score Chegg Com

Accounts Payable Turnover Ratio Formula Example Interpretation

Solved Calculate The Accounts Payable Balance Enter The Chegg Com

Everything There Is To Know About Accounts Payable

Reporting And Analyzing Receivables Boundless Accounting

Solved Calculate The Accounts Payable Balance Enter The Chegg Com

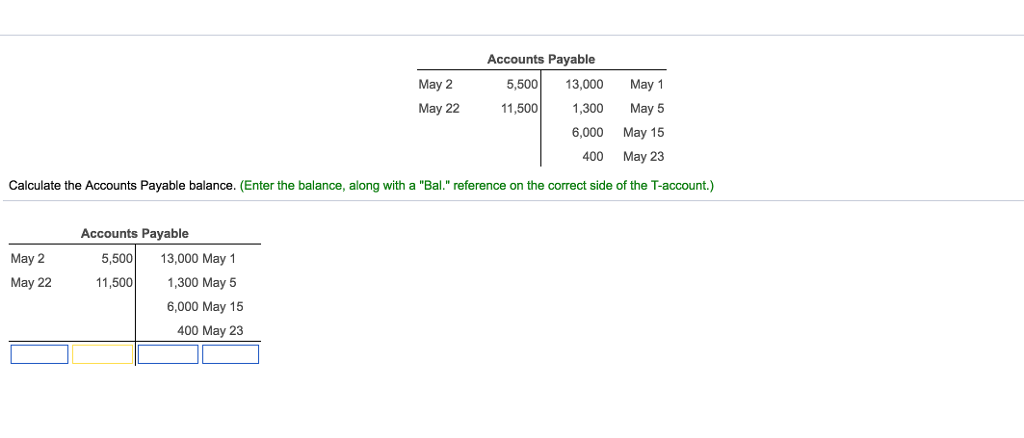

Solved Accounts Payable 5 500 13 000 May 1 May 22300 May 5 Chegg Com

Solved Calculate The Accounts Payable Balance Enter The Chegg Com

Accounts Payable Meaning Importance Example Days

Solved Calculate The Accounts Payable Balance Enter The Chegg Com

Accounts Payable Turnover Ratio Definition Formula Free Template

Comments

Post a Comment